炎順瓦業(yè)

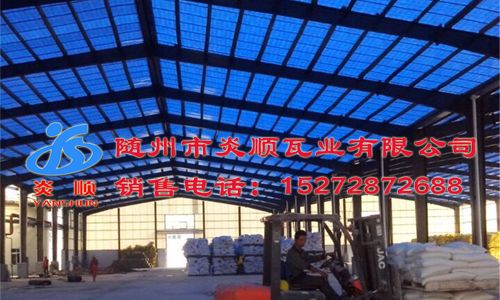

隨州市炎順建材有限公司,位于炎帝神農(nóng)故里,編鐘古樂之鄉(xiāng)——湖北省隨州市;距省會(huì)武漢市186公里,距宜昌三峽330公里,公路、鐵路交通十分便利。

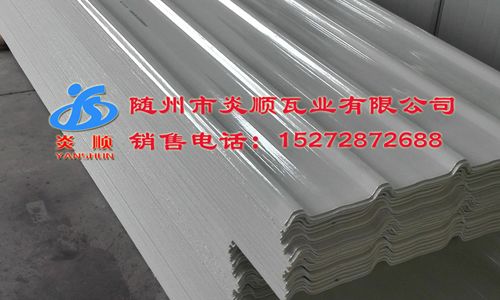

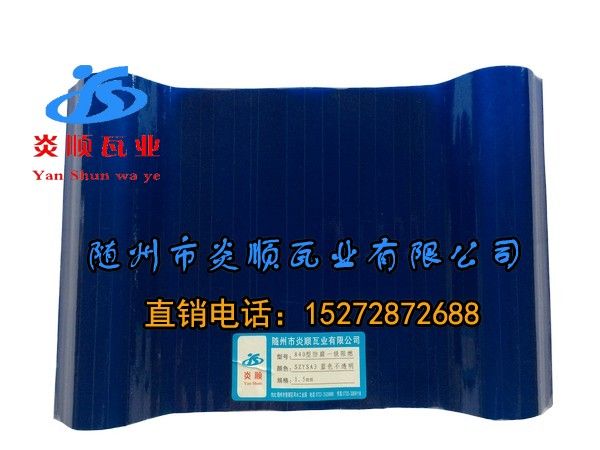

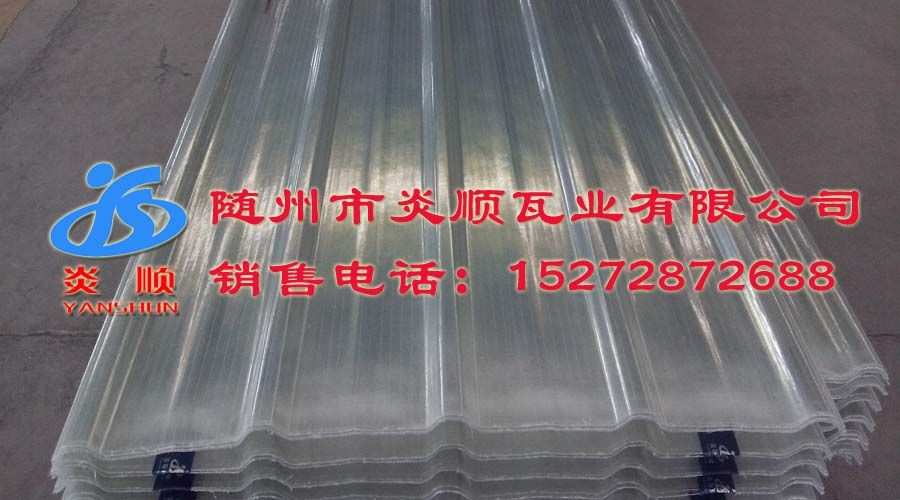

我廠是一家專注于玻璃鋼屋面材料生產(chǎn)、銷售、服務(wù)為一體的企業(yè),主要產(chǎn)品包括:超耐防腐FRP采光瓦、通用FRP采光板材、玻纖布玻璃鋼瓦、平板、水槽、配件等系列產(chǎn)品。

我廠是一家專注于玻璃鋼屋面材料生產(chǎn)、銷售、服務(wù)為一體的企業(yè),主要產(chǎn)品包括:超耐防腐FRP采光瓦、通用FRP采光板材、玻纖布玻璃鋼瓦、平板、水槽、配件等系列產(chǎn)品。

隨州市炎順建材有限公司,位于炎帝神農(nóng)故里,編鐘古樂之鄉(xiāng)——湖北省隨州市;距省會(huì)武漢市186公里,距宜昌三峽330公里,公路、鐵路交通十分便利。

隨州市炎順建材有限公司在湖北隨州、湖南衡陽、福建泉州設(shè)有生產(chǎn)基地,隨州市炎順建材有限公司實(shí)力雄厚、技術(shù)先進(jìn),擁有國內(nèi)外多條FRP采光板柔性生產(chǎn)線,同時(shí)與國內(nèi)相關(guān)行業(yè)緊密合作,隨州市炎順建材有限公司原料配方獨(dú)特。不斷改進(jìn)生產(chǎn)工藝、研發(fā)創(chuàng)新,提高產(chǎn)品質(zhì)量,延伸采光板應(yīng)用領(lǐng)域。

我廠是一家專注于玻璃鋼屋面材料生產(chǎn)、銷售、服務(wù)為一體的企業(yè),主要產(chǎn)品包括:超耐防腐FRP采光瓦、通用FRP采光板材、玻纖布玻璃鋼瓦、平板、水槽、配件等系列產(chǎn)品。

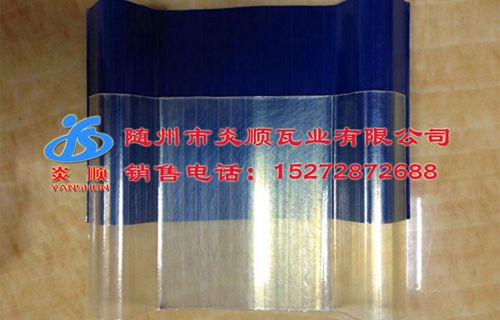

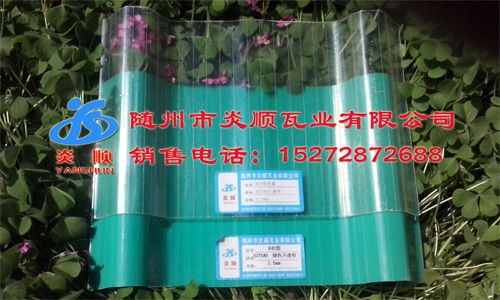

為打造產(chǎn)品,創(chuàng)品牌,我廠引進(jìn)的全自動(dòng)化的FRP采光板生產(chǎn)線,可生產(chǎn)各種規(guī)格透明采光瓦,產(chǎn)品采用優(yōu)質(zhì)聚酯透明樹脂及進(jìn)口抗老化膜,透光率達(dá)85%以上,具有抗沖擊力大、耐老化程度高、耐腐蝕性強(qiáng)、熱膨脹系數(shù)低等優(yōu)點(diǎn)...

- [2019-09-11] 廠房防腐瓦選購4大規(guī)則,防腐瓦都…

- [2019-09-04] 防腐瓦是什么材質(zhì)?

- [2019-08-31] 關(guān)于防腐瓦隔音性的問題

- [2019-08-29] 決定防腐瓦價(jià)格的規(guī)格因素

- [2019-08-21] 防腐瓦可滿足消防防火規(guī)范要求

- [2019-08-20] 企業(yè)選購防腐瓦的三大原則

- [2019-08-19] 防腐瓦秋冬季保養(yǎng)問題

- [2019-08-17] 防腐瓦市場

- [2019-08-15] 防腐瓦有哪些材料組成,特點(diǎn)有什…

- [2019-08-14] 防火瓦又叫阻燃瓦

聯(lián)系我們

|